Nj Veterans Property Tax Exemption 2021 . 100% disabled veteran property tax exemption; Nj state legislature page for s220. 100% disabled veteran property tax exemption. Resident honorably discharged disabled veterans, or their. $250 veteran property tax deduction; If you are an honorably discharged veteran who was 100% permanently and totally. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. Active military service property tax. You may now qualify if: 413 which provides that n.j. This amendment implemented public law 2019, chapter.

from www.exemptform.com

413 which provides that n.j. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. If you are an honorably discharged veteran who was 100% permanently and totally. Active military service property tax. $250 veteran property tax deduction; Resident honorably discharged disabled veterans, or their. This amendment implemented public law 2019, chapter. You may now qualify if: 100% disabled veteran property tax exemption;

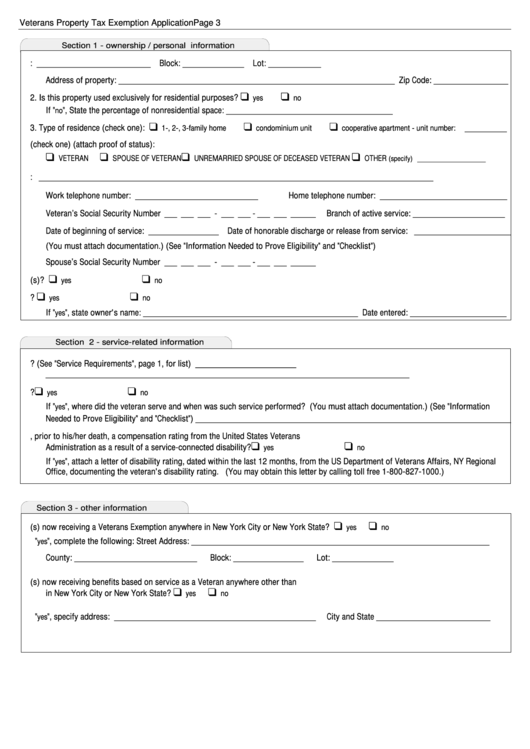

Tax Exemption Form For Veterans

Nj Veterans Property Tax Exemption 2021 If you are an honorably discharged veteran who was 100% permanently and totally. Nj state legislature page for s220. You may now qualify if: $250 veteran property tax deduction; If you are an honorably discharged veteran who was 100% permanently and totally. 100% disabled veteran property tax exemption. Resident honorably discharged disabled veterans, or their. Active military service property tax. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. This amendment implemented public law 2019, chapter. 413 which provides that n.j. 100% disabled veteran property tax exemption; In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed.

From www.youtube.com

VA Disability and Property Tax Exemptions Common Misconception For a Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption; Resident honorably discharged disabled veterans, or their. If you are an honorably discharged veteran who was 100% permanently and totally. 413 which provides that n.j. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. $250 veteran property tax deduction; You may now qualify if: 100% disabled veteran property. Nj Veterans Property Tax Exemption 2021.

From www.hfuw.org

Tax exemptions for Service Members, Veterans and their spouses Nj Veterans Property Tax Exemption 2021 Nj state legislature page for s220. 413 which provides that n.j. You may now qualify if: New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. This amendment implemented public law 2019, chapter. $250 veteran property. Nj Veterans Property Tax Exemption 2021.

From printableformsfree.com

Fillable Form Boe 261 G Claim For Disabled Veterans Property Tax Nj Veterans Property Tax Exemption 2021 Active military service property tax. You may now qualify if: New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. $250 veteran property tax deduction; This amendment implemented public law 2019, chapter. If you are an honorably discharged veteran who was 100% permanently and totally. 100% disabled veteran property tax exemption.. Nj Veterans Property Tax Exemption 2021.

From www.templateroller.com

Vermont Property Tax Exemption for Disabled Veterans and Their Nj Veterans Property Tax Exemption 2021 Active military service property tax. $250 veteran property tax deduction; 100% disabled veteran property tax exemption. You may now qualify if: If you are an honorably discharged veteran who was 100% permanently and totally. Resident honorably discharged disabled veterans, or their. Nj state legislature page for s220. New jersey has long provided a property tax deduction of $250 to some. Nj Veterans Property Tax Exemption 2021.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Nj Veterans Property Tax Exemption 2021 This amendment implemented public law 2019, chapter. Resident honorably discharged disabled veterans, or their. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. 100% disabled veteran property tax exemption. 100% disabled veteran property tax exemption; 413 which provides that n.j. If you are an honorably discharged veteran who was 100% permanently and totally. New. Nj Veterans Property Tax Exemption 2021.

From www.exemptform.com

Veteran Tax Exemption Submission Form Nj Veterans Property Tax Exemption 2021 This amendment implemented public law 2019, chapter. 100% disabled veteran property tax exemption; $250 veteran property tax deduction; Nj state legislature page for s220. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. Resident honorably discharged disabled veterans, or their. In late 2020, the requirements for the $250 new jersey. Nj Veterans Property Tax Exemption 2021.

From www.templateroller.com

New Jersey Claim for Property Tax Exemption on Dwelling of Disabled Nj Veterans Property Tax Exemption 2021 Resident honorably discharged disabled veterans, or their. 100% disabled veteran property tax exemption. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. $250 veteran property tax deduction; 100% disabled veteran property tax exemption; This amendment implemented public law 2019, chapter. Active military service property tax. If you are an honorably discharged veteran who was. Nj Veterans Property Tax Exemption 2021.

From www.uslegalforms.com

IL Disabled Veterans Standard Homeowner Exemption Cook County Fill Nj Veterans Property Tax Exemption 2021 In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. 413 which provides that n.j. Nj state legislature page for s220. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. Resident honorably discharged disabled veterans, or their. Active military service property tax. You may now. Nj Veterans Property Tax Exemption 2021.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption. Active military service property tax. Nj state legislature page for s220. Resident honorably discharged disabled veterans, or their. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. 413 which. Nj Veterans Property Tax Exemption 2021.

From www.youtube.com

Texas Disabled Veteran Property Tax Exemption (EXPLAINED) YouTube Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. Resident honorably discharged disabled veterans, or their. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. If you are an honorably discharged veteran who was 100% permanently and totally.. Nj Veterans Property Tax Exemption 2021.

From www.uslegalforms.com

Nj Tax Exempt Form St 5 20202022 Fill and Sign Printable Template Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption; 413 which provides that n.j. 100% disabled veteran property tax exemption. Resident honorably discharged disabled veterans, or their. If you are an honorably discharged veteran who was 100% permanently and totally. Active military service property tax. This amendment implemented public law 2019, chapter. You may now qualify if: Nj state legislature page for s220. Nj Veterans Property Tax Exemption 2021.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Nj Veterans Property Tax Exemption 2021 This amendment implemented public law 2019, chapter. 100% disabled veteran property tax exemption; New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. You may now qualify if: 100% disabled veteran property tax exemption. If you are an honorably discharged veteran who was 100% permanently and totally. 413 which provides that. Nj Veterans Property Tax Exemption 2021.

From www.lcvetsfoundation.org

2023 Disabled Veteran Property Tax Exemption Lake County Veterans and Nj Veterans Property Tax Exemption 2021 Resident honorably discharged disabled veterans, or their. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. If you are an honorably discharged veteran who was 100% permanently and totally. 100% disabled veteran property tax exemption; In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed.. Nj Veterans Property Tax Exemption 2021.

From www.youtube.com

Property Tax Exemptions for Veterans YouTube Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption; You may now qualify if: New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. This amendment implemented public law 2019, chapter. $250 veteran property tax deduction; Active military service property tax. 413 which provides that n.j. Nj state legislature page for s220. Resident honorably. Nj Veterans Property Tax Exemption 2021.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Nj Veterans Property Tax Exemption 2021 You may now qualify if: $250 veteran property tax deduction; 100% disabled veteran property tax exemption; Resident honorably discharged disabled veterans, or their. Nj state legislature page for s220. In late 2020, the requirements for the $250 new jersey veteran property tax deduction changed. 413 which provides that n.j. 100% disabled veteran property tax exemption. New jersey has long provided. Nj Veterans Property Tax Exemption 2021.

From www.exemptform.com

Tax Exemption Form For Veterans Nj Veterans Property Tax Exemption 2021 New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. $250 veteran property tax deduction; Resident honorably discharged disabled veterans, or their. If you are an honorably discharged veteran who was 100% permanently and totally. Active military service property tax. 100% disabled veteran property tax exemption; This amendment implemented public law. Nj Veterans Property Tax Exemption 2021.

From www.fox17online.com

EGR veteran pushes for changes to state's disabled veterans exemption Nj Veterans Property Tax Exemption 2021 If you are an honorably discharged veteran who was 100% permanently and totally. Nj state legislature page for s220. New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. Active military service property tax. 100% disabled veteran property tax exemption; 413 which provides that n.j. You may now qualify if: 100%. Nj Veterans Property Tax Exemption 2021.

From www.youtube.com

Property Tax Exemption for Veterans & Surviving Spouse Know Your Nj Veterans Property Tax Exemption 2021 100% disabled veteran property tax exemption; New jersey has long provided a property tax deduction of $250 to some wartime veterans and their surviving spouses. This amendment implemented public law 2019, chapter. 413 which provides that n.j. You may now qualify if: $250 veteran property tax deduction; Nj state legislature page for s220. In late 2020, the requirements for the. Nj Veterans Property Tax Exemption 2021.